Maybe now is the time to learn how to invest in stock, without spending your own money.

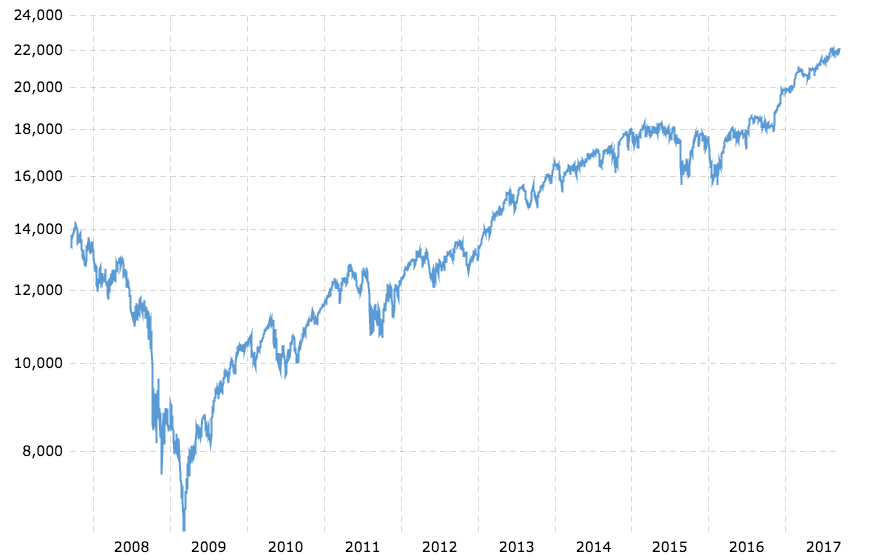

The stock market has been skyrocketing. Have you noticed?

2008 was an awful year. 2015 and early 2016 had some bumps. The rest of 2016 and 2017 so far have been almost nothing but up. There are no guarantees in life but investing in the stock market, over time, has always been a good bet. After all, you are betting on the success of American businesses (if in fact you choose to invest in American businesses).

Have you found yourself wishing you could buy in, but either don’t know how to invest in stock, or don’t want to take the risk? I’ve got a suggestion for you. Use cash back from your day to day credit card spending.

Use Free money to Learn how to Invest

Fidelity offers a Visa card that pays 2% cash back – on every single thing you buy. It’s been one of the best cash back cards for quite a while (I have had one for several years – since it was an Amex). What makes Fidelity different from other cash back credit cards is they dump your cash back into an investment account that you can use to buy stock. (If you want to withdraw the cash, or sell whatever you stock you buy, you can do so easily).

Get the Card.

Get the card. Use it for EVERYTHING (and pay off in full monthly of course). Put your utilities on it, food, and anything else you buy. 2% cash back is way better than skymiles or any of the other bonus programs out there with one exception – the 5% cards that apply to specific (meaningful) categories.

I only have one other card. It pays 5% cash back on gas, and 3% back on purchases at grocery stores. That cash back builds up as “points” that I use it to buy a prepaid debit card. I then transfer that amount of money from my bank account to my Fidelity account and use the prepaid card for everyday spending till it’s gone. If you wanted to get that fancy you can, but at least start with the Fidelity card.

Watch the Cash pile up

Once the money shows up in your investment account don’t feel like you have to buy anything right away. Take your time, the money isn’t going anywhere.

Research stocks.

Research, read, look at charts, ask friends what they buy. Just learn, read, and ask questions. Again, no reason to get in a hurry. Time is on your side.

Jump in

At some point, you gotta buy something if you want to learn how to invest in stock. Buying something will cause you to learn more than you can imagine. You will start watching it daily and researching things you don’t understand. One thing will lead to another until you get more and more comfortable buying and selling.

What I did

I followed the plan laid out above and jumped in once I had a little cash back built up. Over the course of a few years I amassed almost $40,000.00 in my account. About half of that was cash back, and the growth from the stock I bought. The other half was cash and growth from cash I transferred in once I got the hang of things.

I lost a little money on a few things, but for the most part I made money on almost everything I bought.

- I bought Facebook when it IPO’ed. It went from $38 to about $140 when I sold all but one share of it earlier this year. It’s up to $172 today.

- I bought Dominos in 2013 for about $51 a share. I sold all but one share in march of this year for $184 a share. It is at $189 today.

- I also bought and sold Disney, Google (Alphabet), Home Depot, Apple, Cisco, Dollar General, Coca Cola, Netflix, Tesla, VMWare, Western Digital, Walmart, Techtronic (Makers of Ryobi tools), and a few others.

I made a pile of money buying and selling those stocks. I probably got lucky, but here is how I did it.

- I looked for things I liked. I liked how Dominos did things. I saw that they were advancing their technology. I said in my mind “They need an app for the phone”. I walked in one day and saw a sign announcing the app – I bought stock that day.

- I looked for things that seemed to make sense. I saw Dollar General’s popping up everywhere. Small convenient retail that appeals to low and middle class earners that probably aren’t using Amazon for a variety of reasons.

- I looked at the trends of huge and popular companies like Home Depot and Coca Cola. If they were in a dip or coming out of one, I bought. These companies generally go up over long periods of time. I figured if I could get in when they were at a low spot I would do well.

- I made assumptions about what was coming around the corner. I read that Western Digital had more capacity than anyone in solid state drives at the time. I bought before I finished reading the article.

- In general, I followed my gut. I did look at charts, and I tried to buy things that were coming out of a dip. Sometimes I didn’t care if there was a dip (like with Amazon) because I knew it was only going up.

A few months ago I decided that being debt free was more important than owning stock. (Another post on that subject is forthcoming). So, I sold everything in my account except one share of everything. (I kept one share so it would keep my interest). My cash back still continues to build and it’s about time to start buying again.

Summary

At the end of the day, investing in stock is not for everyone. But, here is what I would say. Get the card, get the cash back flowing, and when you have made it that far you can decide. Let me know if you want to talk. At a minimum don’t leave money (your cash back) on the table!

Craig Haynie

[I am not a financial advisor and my advice should be taken with a grain of salt, or ignored completely. I am not getting paid by Fidelity in any way to link to their site or suggest you signup for their card]